Condo Insurance in and around Kenosha

Kenosha! Look no further for condo insurance

State Farm can help you with condo insurance

There’s No Place Like Home

There is much to consider, like savings options deductibles, and more, when looking for the right condo insurance. With State Farm, this doesn't have to be a hassle of a decision. Not only is the coverage incredible, but it is also competitively priced. And that's not all! The coverage can help provide protection for your condominium and also your personal property inside, including things like shoes, clothing and sound equipment.

Kenosha! Look no further for condo insurance

State Farm can help you with condo insurance

State Farm Can Insure Your Condominium, Too

When a tornado, a hailstorm or fire cause unexpected damage to your condominium or someone has an accident because of negligence on your part, having the right coverage is significant. That's why State Farm offers such excellent condo unitowners insurance.

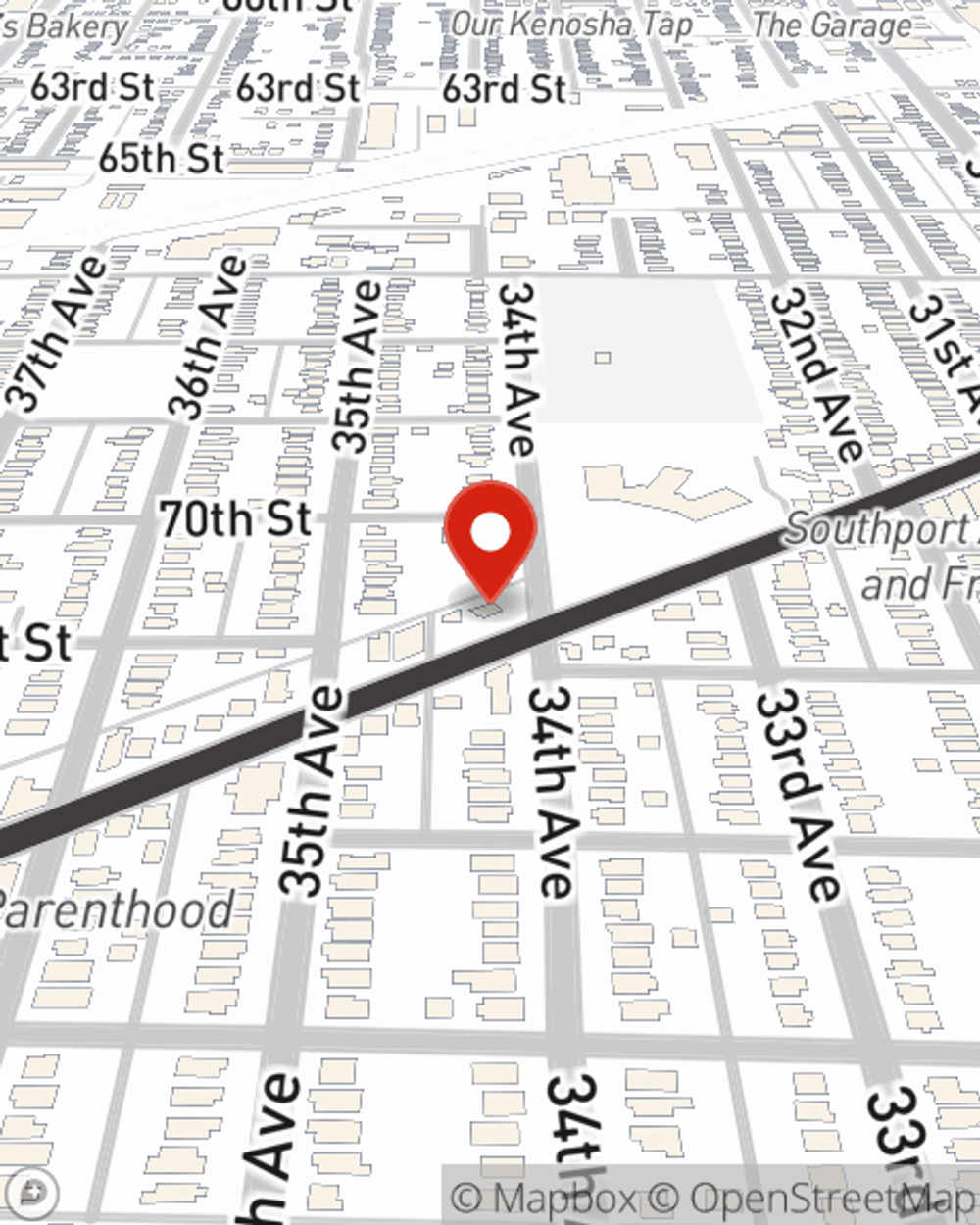

As a value-driven provider of condo unitowners insurance in Kenosha, WI, State Farm aims to keep your belongings protected. Call State Farm agent Rob Fleming today and see how you can save.

Have More Questions About Condo Unitowners Insurance?

Call Rob at (262) 656-1414 or visit our FAQ page.

Simple Insights®

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Rob Fleming

State Farm® Insurance AgentSimple Insights®

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.